The Vision

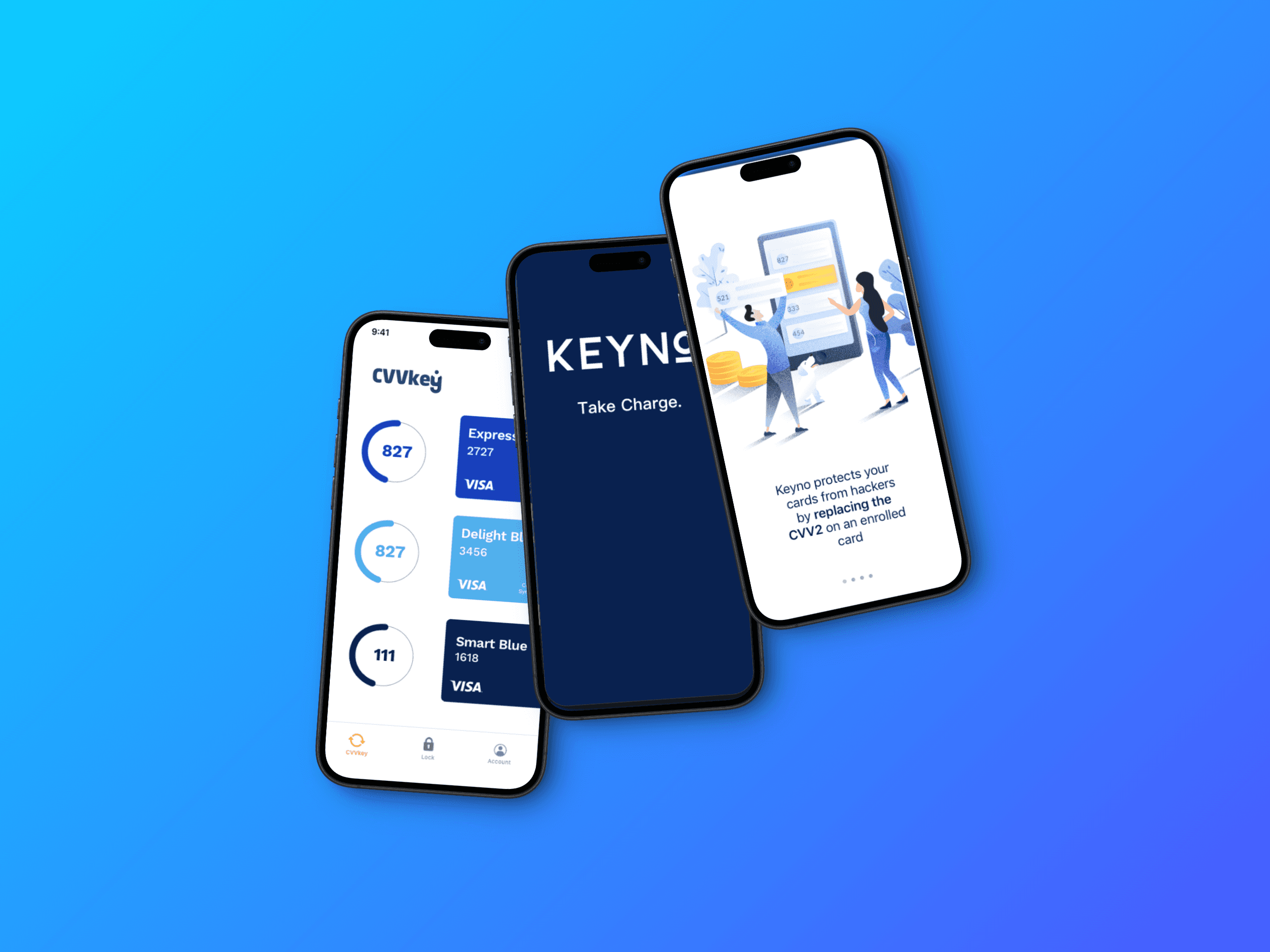

Keyno's solution was to transform the static CVV code (3-digit security code on credit cards) into a dynamic number that changes with each transaction. This innovation prevented fraud by making stolen data unusable.

The Challange

The service was offered to banks, allowing them to protect themselves and their customers. However, our success depended on addressing key user concerns:

Educating cardholders about dynamic CVV codes

Simplifying the enrollment process

Ensuring the experience was intuitive and secure across all devices

Research

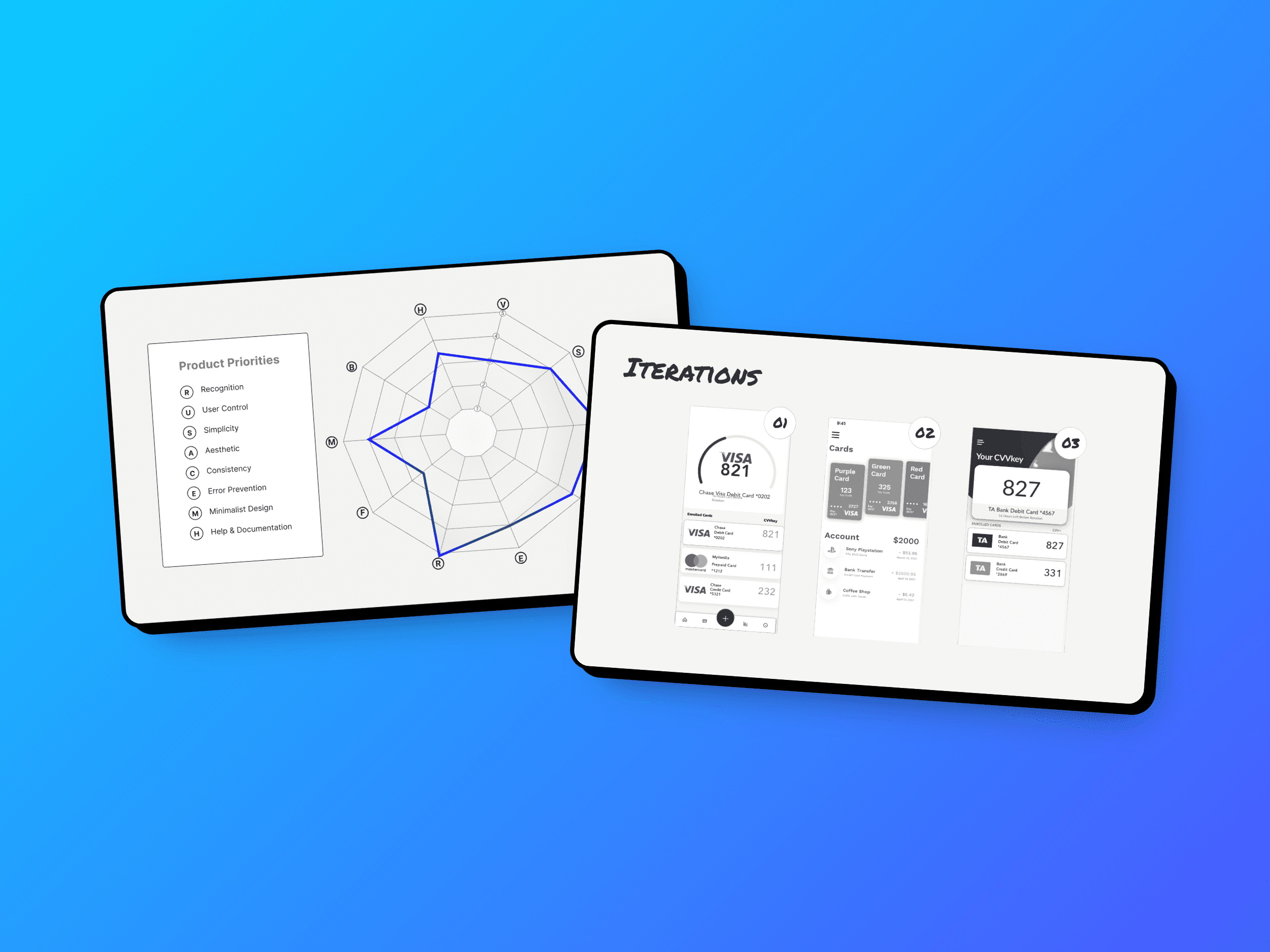

At the start, we didn’t know what the final product would look like. To navigate this uncertainty, I conducted:

User and market research

Surveys with over 1,000 cardholders

Persona creation and user flow mapping

These insights helped us understand user behavior and preferences, solidifying the decision to develop a mobile app for its perceived security and convenience.

Our Goals

My primary goal was to make a product anyone could use the first time they picked up the app.

User Education: Help users understand the dynamic CVV concept and its benefits.

Intuitive Design: Create simple, user-friendly interfaces that make enrollment and usage effortless.

Security Assurance: Build trust by emphasizing the app's security through design.

Validation: Test assumptions and iterate based on user feedback to ensure a seamless experience.

Consistency: Balance innovation with familiarity by aligning with user expectations and existing mental models.

Key Decisions

My design goals for the Keyno were:

Make the Card a Clear Focal Point: Ensure the card design is intuitive and serves as a clear reference for users interacting with their dynamic CVV.

Create Familiar Interactions: Implement a scrolling interaction to display CVV codes, mimicking a familiar format like Google Authenticator, to make the experience more intuitive.

Set Clear Expectations: Use a timer to communicate when the CVV code will expire, reinforcing trust and usability.

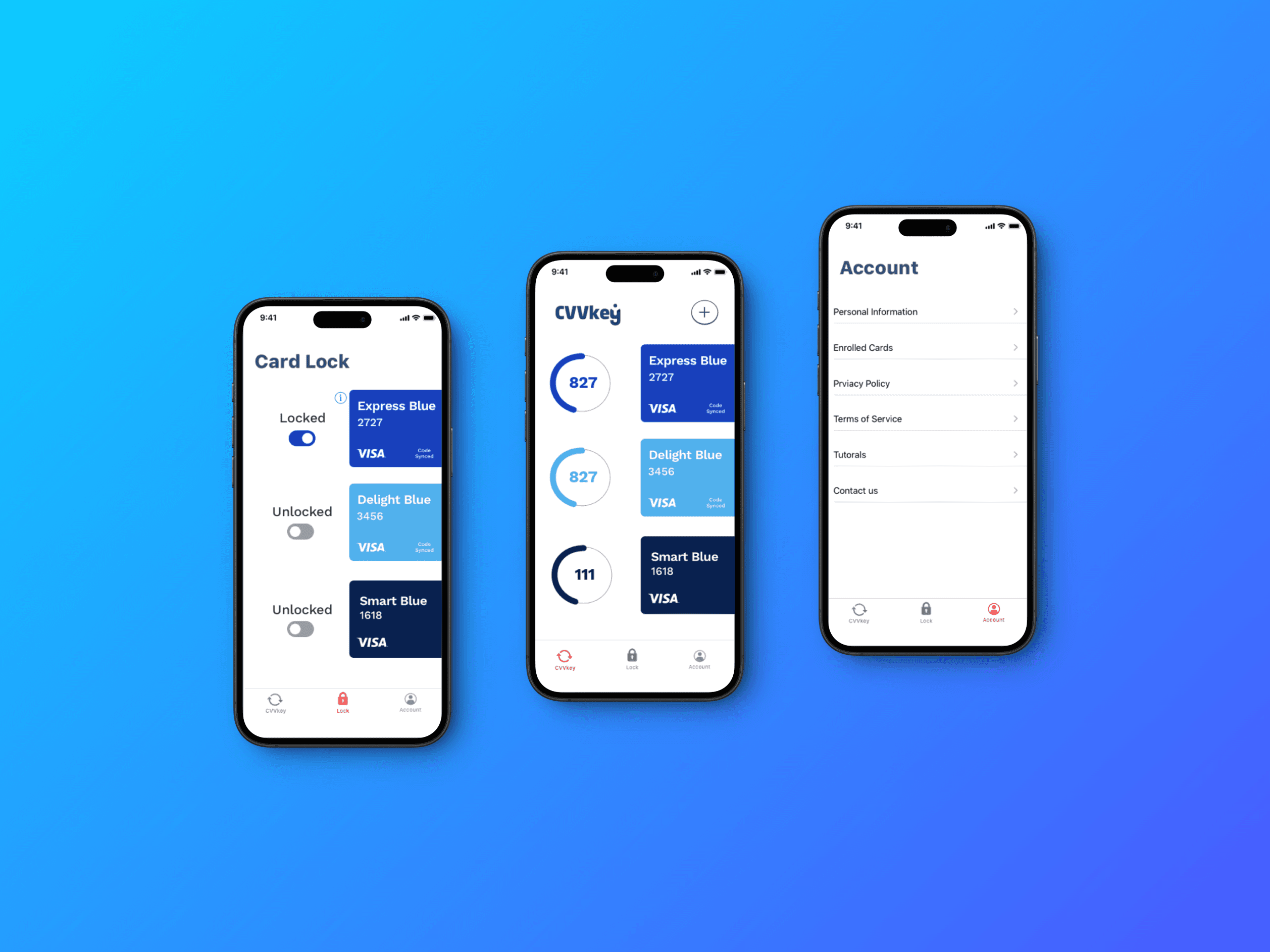

Expand Security Features: Introduce a card lock feature to showcase potential security enhancements, offering greater value to cardholders and inspiring future innovations.

Significance

Keyno's app is now used by nine banks worldwide, serving over 500,000 users. With a churn rate of less than 0.5%, the app has become a trusted tool in fraud prevention. Discussions with Visa and Mastercard to white-label the product further highlight its success. What excites me most is the 95% reduction in fraud the app delivers, proving that thoughtful design can have a tangible impact on real-world problems.